It’s an unusual scene, but it takes place many times every day in thousands of offices. Professionals working in financial services companies — accounting practices, commercial banks, mortgage brokerages, investment houses, etc. — walk to and from desktop fax machines and fax-enabled multifunction printers all day, sending and receiving hardcopies of important financial documents.

As an IT professional in the financial services industry, it has probably occurred to you that paper-based faxing is a less-than-ideal way to transmit sensitive documents, for at least a couple of reasons.

First, the personally identifiable information (PII) about your customers that your industry generates, transmits and stores is among the most popular data for cybercriminals to steal. As a 2016 IBM Security study reported in Forbes pointed out, financial services suffered the third most data breaches of any industry — behind only healthcare and manufacturing. And there has to be a more secure method for transmitting your customers’ personal financial information than by printing it out, feeding it into a fax machine and then sending that data unsecured over the public phone network.

The second reason faxing might stand out to you as a suboptimal method for sending and receiving customer data is that, given the security and regulatory demands on your industry, you’ve almost certainly had to upgrade other areas of your IT infrastructure in recent years to fortify your data defenses. So, although your IT department has probably deployed sophisticated new systems to protect your onsite servers, your corporate email and your workflow and communication tools, when it comes to faxing you’re still using the same analog-era infrastructure of fax machines, multifunction printers and in-house fax servers.

If you and your IT team are frustrated maintaining your legacy fax infrastructure, I have good news and bad news. The bad news, as you’ll see below, is that your staff’s use of fax is probably here to stay for the foreseeable future. But the good news — great news, actually — is that you don’t need to keep supporting any of that 1980s fax hardware. In fact, when you partner with a cloud fax company that’s experienced in the financial services industry, you’ll be able to confidently outsource your entire fax infrastructure to a trusted expert.

For the Financial Services Industry, Fax Isn’t Going Away

Remember how I mentioned there was some bad news? Well, it seems pretty clear that you and your IT team won’t have any say in whether or not your organization continues to use fax to send and receive sensitive customer data. Like it or not, they will.

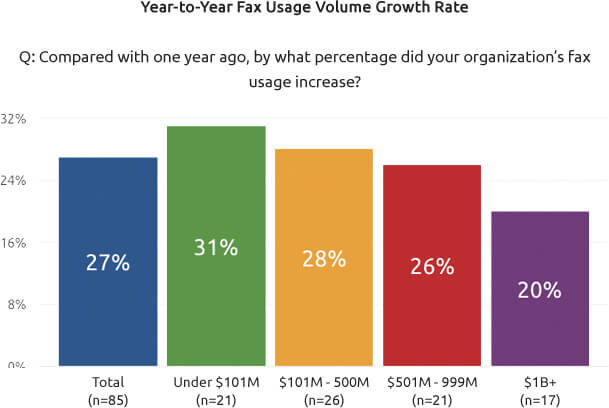

When the research firm IDC conducted its “Fax Market Pulse” study — which included surveys of businesses in four key industries, including financial services — researchers found that companies across all of these industries were experiencing an increase in fax usage from year to year.

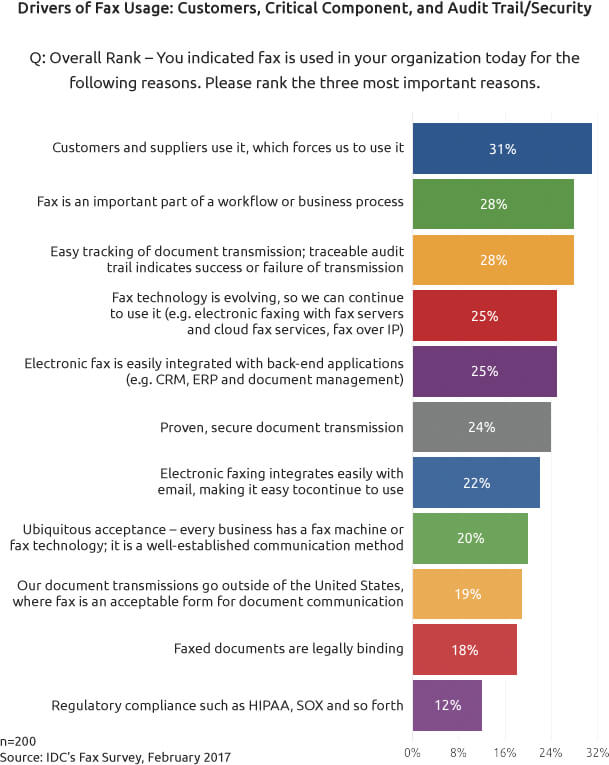

Moreover, when asked why their fax usage was growing, the most common answer was that “Customers and suppliers use it, which forces us to use it.”

In many cases, your employees are likely still faxing because that’s how your vendors, partners and other third parties demand that you communicate with them. Larger financial institutions, insurance providers, government entities like the SEC, independent regulatory bodies like FINRA — all of these entities continue to use fax and often demand that the businesses they work with use it as well.

And if you can stomach a bit of more bad news, it’s important for you to understand that if you continue to support your staff’s faxing needs with your legacy fax infrastructure, this can have several negative consequences for your company. Here are just a few of them.

(That great news I mentioned? It’s coming soon — I promise.)

Three Unique Challenges Traditional Faxing Poses

1. Traditional fax documents are not secure

You might not have given this much thought — email and network hacks grab all of the headlines — but a traditional fax transmission is relatively secure only during the actual transmission phase The documents are not encrypted and may not even be password protected at the receiving end. Any documents left unattended on the machine at either end-point are vulnerable to unintended access or theft of confidential information. While you may be able to protect the fax at your end by standing at the machine while it sends and waiting for the delivery confirmation receipt before removing the document, what happens at the other end is out of your control.

2. Faxed data stored in a fax machine or multifunction printer can be hacked as well

Although most people tend to think about only the fax transmission, it’s important to remember that a faxed document then lives on forever in storage, in either electronic or physical form, or both.

When your employee sends a fax containing sensitive customer financial data — even if the employee securely files or destroys that physical copy of the document — the fax machine will maintain an unprotected electronic record of the document in its memory or hard drive. Same goes for a multifunction printer. And if those devices in your office are connected to your corporate network, a hacker could grab that fax data remotely.

Of course, you might be thinking that your faxes will fly under the hackers’ radar. And this might well be true: The cybercriminals after your data will probably be focused on trying to penetrate your email network, for example.

Still, though, these security vulnerabilities of your fax infrastructure still pose a regulatory problem.

3. The analog fax infrastructure of the typical financial services firm probably falls short of regulatory compliance

Sarbanes-Oxley (SOX) and The Gramm-Leach-Bliley Act (GLBA)are among the strictest and most aggressively enforced federal data-privacy laws ever written for any industry.

SOX, for example, establishes strict rules for companies in your industry about records retention and how securely you maintain your archived PII? Under GLBA, a financial services business that violates any portion of the law can be fined up to $100,000 for each violation.

From a regulatory standpoint, your analog fax infrastructure likely falls short of compliance with these laws in at least a couple of respects. Because a paper fax can be left sitting on a fax machine or multifunction printer in an office’s common areas — where anyone passing by could view your customers’ personal data — transmitting PII with a desktop fax machine could be deemed noncompliant with SOX or GLBA.

Plus, the memory and hard drives of those machines contain copies of the faxes with all of the confidential financial information in an unprotected state where it is often forgotten. There have been actual cases of compliance violations where leased equipment was returned to the supplier, chock full of confidential customer financial data, because nobody thought to wipe the storage of those devices first.

Also, because fax server hardware such as the hard drives of often have to be “purged” to make room for new fax data — and because this purging often includes printing copies of the drive’s stored faxes for filing — this process, too, can land a financial services firm on the wrong side of regulators.

Yes, your company will probably continue to need fax capability for years. But your IT team doesn’t need to manage any of it.

Why Cloud Faxing is Ideal for Industries Like Financial Services — and Why More Firms Trust eFax Corporate

Okay, time for the great news.

Even though your organization will almost certainly continue to need faxing capability for the foreseeable future to transmit customers’ personal data, you and your IT team don’t need to keep devoting time and energy overseeing your outdated, aging and difficult-to-maintain fax infrastructure.

In fact, your IT team doesn’t need to continue managing your fax infrastructure at all.

With just a single move — a fast, painless migration to a fully hosted cloud fax platform — you can outsource all of your fax management responsibilities to a trusted partner, and at the same time enhance your company’s fax security and regulatory compliance and even boost employee productivity.

SOX and GLBA are among the strictest data-privacy laws on the books. And your current faxing processes probably fall short of compliance.

When you partner with the right cloud fax service, your institution enjoys a wide range of benefits, such as:

– Enhanced fax security through encrypted and authenticated email and storage

– Improved compliance with SOX and GLBA

– Comprehensive audit trails and better record-keeping — ideal for complying with regulators

– A boost in productivity — by enabling your employees to securely fax by email, even from their smartphones

– More visibility into your company’s fax usage — including real-time data and reporting available through an online portal

– Lowered costs — by eliminating the overhead to maintain your legacy fax infrastructure and instead paying only for the cloud fax bandwidth your institution actually uses

Yes, your company will probably continue to need fax capability for years. But your IT team doesn’t need to manage any of it.

When you’re ready to migrate your company’s faxing to a cloud fax provider, the simplest, smartest choice for your organization — as it’s been for more than half of all Fortune 500 firms — will be to partner with eFax Corporate, the number one enterprise-caliber secure fax service for two decades.

With a cloud fax platform designed for the unique security and regulatory challenges of financial services firms, eFax Corporate knows how to deploy a custom cloud fax solution that meets your firm’s needs for robust faxing capability, that helps bring your processes in line with regulators, that protects your fax data with the most advanced security available, and that will even lower your overall fax costs.

Let us build you a custom quote.