If your organization is like many in today’s automotive finance industry, the following scene in your offices is probably quite typical.

A customer faxes over a portion of her application paperwork — proof of identity and residence, proof of insurance, proof of income, and of course the completed loan application itself. Because the loan processor working with this customer has stepped out for lunch, these documents — which contain a wealth of personally identifiable information (PII) — will probably sit on your office’s fax machine for an hour or so before the processor returns. It is also possible that someone else in the office will grab the documents and walk them over to the processor’s desk.

You might not realize this, but that seemingly harmless scenario could put your company on the wrong side of at least one industry or governmental data privacy law — and possibly several of them. In fact, even if your organization uses in-house fax servers as opposed to desktop fax machines for sending and receiving your customers’ PII, you might still be in noncompliance with several regulations.

How Traditional Faxing in the Automotive Finance Industry Can Fall Short of Compliance with PCI, SOX and GLBA

The Payment Card Industry (PCI) has developed and now oversees a strict information-security standard for any business that handles or processes credit card data.

If your company collects and maintains customers’ credit card information, you are likely already PCI compliant in many respects, particularly when it comes to securely storing that data when you receive it in electronic format such as email or through your company’s website.

But what you might not be aware of — most businesses in the financial services industry are not — is that PCI compliance also covers how well a merchant secures its cardholder data that is printed. To be PCI compliant in this respect, you need measures in place to ensure that 1) any printed cardholder information is physically secured and that 2) access to viewing such data is limited to authorized personnel only.

Similarly, many financial industry organizations do not realize that federal laws such as Sarbanes Oxley (SOX) and The Gramm-Leach-Bliley Act (GLBA) also affect how these companies send, receive and store physical fax documents. With these and other data privacy laws, businesses handling PII or other sensitive information on their customers have a legal responsibility to secure and limit access to this data at all times.

Sensitive customer documentation left sitting on a fax machine, cardholder data being “purged” from the maxed-out hard drive of a fax server for filing or destruction, and other common occurrences at financial-services companies can all lead to compliance violations — and to the steep penalties and negative publicity that regulatory investigations can bring about.

As many businesses in the automotive lending industry are discovering, many of their standard communication and documentation-transmission practices — particularly when it comes to their fax infrastructure — might fail to comply with a host of aggressively enforced privacy regulations.

Moreover, regulatory compliance is just one reason that so many forward-thinking automotive finance businesses are retiring their legacy fax infrastructure and outsourcing the entire process to a trusted cloud fax provider.

Many automotive finance businesses are discovering their fax processes might not be compliant with PCI, SOX, GLBA and other regs.

3 Reasons Auto Lending Companies Are Adopting Cloud Fax Technology

1. Cloud faxing streamlines workflows and boosts productivity

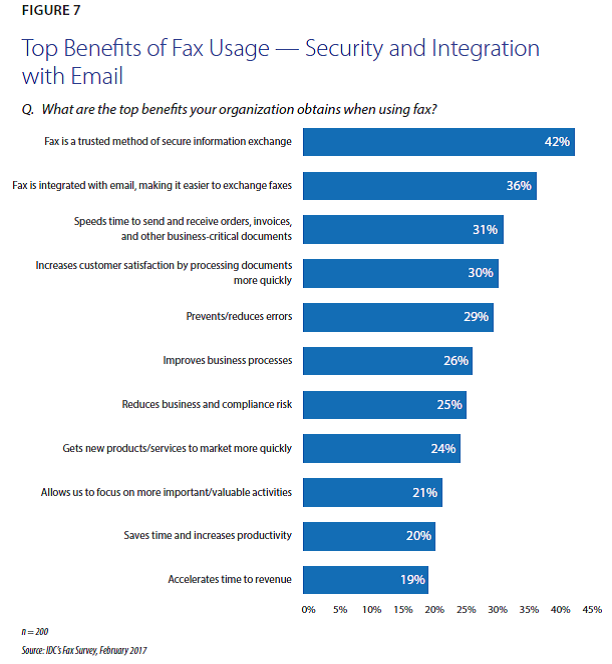

The research firm IDC released a “Fax Market Pulse” study in 2017, which reported on the fax usage of four major industries — including financial services.

When asked about the top difficulties they faced with their fax processes, respondents listed as their number-one challenge the “wasteful” time their staff is forced to spend sending and receiving paper fax documents.

This widespread concern helps explain why, when businesses in these industries were asked which solutions they wanted to use to help automate their faxing processes, one of the two top answers given — 49% of all respondents agreed — was to integrate faxing with their email applications, as shown in the chart below.

That makes sense. When your loan officers and other employees are receiving and sending so many documents each day by fax, you sacrifice some productivity by forcing them all to share one or a few office fax machines. Wouldn’t it be far more efficient to empower your staff to fax by email?

Indeed, one of the best ways to speed and improve your fax processes is to allow employees to fax from anywhere, anytime — and without having to print hardcopies of the documents and then wait by a fax machine or multifunction printer for those pages to be fed through.

With a cloud fax solution, your employees can receive, review, edit, sign and send fax documents by email — streamlining your staff’s workflows and improving the productivity of every employees (loan officers, processors and others) whose job involves regularly faxing customer documentation.

Cloud Fax by email also improves security and regulatory compliance by making sure that no one other than the intended recipient sees the fax which goes directly into their email inbox.

Many automotive finance businesses are finding out their fax processes might not comply with PCI, SOX, GLBA and other regs.

2. Cloud faxing lowers the costs of a company’s overall fax infrastructure

In the IDC’s “Fax Market Pulse” report, the second-biggest challenge respondents listed for their existing fax infrastructure was the cost of manual, paper-based faxing.

This makes sense as well, when you consider all of the costs associated with maintaining an enterprise legacy fax infrastructure — not even including the “hidden” expenses.

To keep a traditional, in-house fax architecture operating smoothly requires a business to continually spend on paper, ink, dedicated analog phone lines, maintenance and repairs for hardware itself, fax software license renewals to operate the organization’s fax servers, etc.

All of which is to say nothing of the lesser-known charges that businesses are spending year after year to prop up their old fax infrastructure — often without even realizing it. These include your IT department’s time spent troubleshooting failing fax machines, rebooting crashed fax servers, and training new employees on the company’s fax infrastructure.

Other hidden fax expenses include high costs of fax server electricity and the high fixed monthly charges you are probably paying to maintain a given amount of fax transmission bandwidth — even though your company probably isn’t using a lot of that bandwidth.

With the right enterprise-caliber cloud fax service, by contrast — particularly a cloud fax solution developed with financial-service business in mind — you will eliminate virtually all of these expenses.

Cloud faxing allows your IT team to outsource your entire fax infrastructure to a fully hosted fax service. Instead of paying to maintain in-house fax machines, servers and fax landlines, your company will pay only for the bandwidth you use as your employees send and receive faxes by email, through a web portal, or online via their cloud-fax mobile apps. No more fax lines, no more fax-machine maintenance agreements, and no more IT time spent troubleshooting employees’ fax problems.

In fact, with the right cloud fax provider, you can establish a pay-as-you-go plan — so your company does not needlessly pay for high fax capacity during those periods when your actual fax usage is low.

3. Cloud faxing is more secure — and compliant — than traditional fax infrastructure

Because your organization’s faxes so often contain highly sensitive customer information — full names, addresses, Social Security numbers, and of course credit information — data security is likely more of a concern for your business than for companies in other industries.

Indeed, in that IDC report, one of the reasons many businesses gave for continuing to use fax was that faxing is a secure method of document transmission.

This is true in a sense. Analog faxes can be more secure than unencrypted emails traversing the Internet over unsecured networks.

Fax might also seem like a smart option from a security standpoint because today’s many high-profile cases suggest hackers are primarily targeting email and companies’ digital networks — not their analog fax transmissions.

But analog faxing, too, has security weaknesses. For example, faxes sent from your desktop fax machine almost certainly travel over the Public Switched Telephone Network, and those transmissions are not encrypted.

Consider also that a fax machine’s hard drive also maintains records of documents sent or received through the machine — making that data vulnerable to physical theft. Moreover, as we discussed earlier, fax documents left unattended on a desktop fax machine could be seen by anyone who happens to be in your office.

In addition to the compliance issues these fax vulnerabilities create, they can also leave your company exposed to actual data theft.

But a secure cloud fax solution, your faxes will have more security than they’ve ever had in your legacy fax infrastructure and even greater levels of security than they would if they were sent through the typical email system.

Also, your faxes will enjoy the most advanced security and encryption protocols not only while they’re in transit — but also after they’ve been received by your company’s fax number and are ready to be digitally archived. That’s because the right cloud fax provider will also maintain the most secure offsite data centers to store and protect your archived faxes 24/7, forever.

Trust the Cloud Fax Industry Leader: eFax Corporate

So, who is the “right cloud fax platform” that I keep referencing here?

It’s eFax Corporate — the #1 cloud fax partner for the automotive finance industry, the choice of more than half of all Fortune 500 companies, and the partner to more businesses in heavily regulated industries than any cloud fax provider.

Our cloud fax services can help your automotive finance business improve workflows and productivity, improve your compliance with privacy regulations, and enhance your fax security.

Let us build you a custom quote.